My father had an unwavering, unconditional love for my brother Neil and I. He rarely got angry with us, never punished us, and mostly wanted us to learn from our mistakes.

In the case of Neil, this was easy. Neil was a very good kid and never got into any trouble.

He gave my dad a little angst about 50 years ago when, after getting his doctorate, he started his recycling activities, which was a new field that my dad didn’t understand. (“He has a Ph.D., why is he getting involved with garbage.”)

Of course he soon became very proud of how Neil helped communities around the country create jobs and protect their environment. With me his patience was tested many times; an elementary school suspension, numerous drinking incidents, a car crash, two years of academic probation at Cornell, loud/long arguments with my mom, and my losing his money in an investment scheme. There are two of these incidents I want to highlight because my dad’s response was memorable and maybe unique.

– In 1950 when I was 6 years old, my second grade teacher suspended me from school for taking bets on professional basketball;

– In 1975 I convinced my dad to invest with me in a commodity trading plan and in 3 weeks we lost 65% of our investment.

Before I flesh out the details of these events and tell you how he handled them, I want to give you some context by telling you what it was like to grow up with my dad in our Sheepshead Bay neighborhood in Brooklyn. At a minimum this will help you understand how a boy could become a bookmaker at the age of 6.

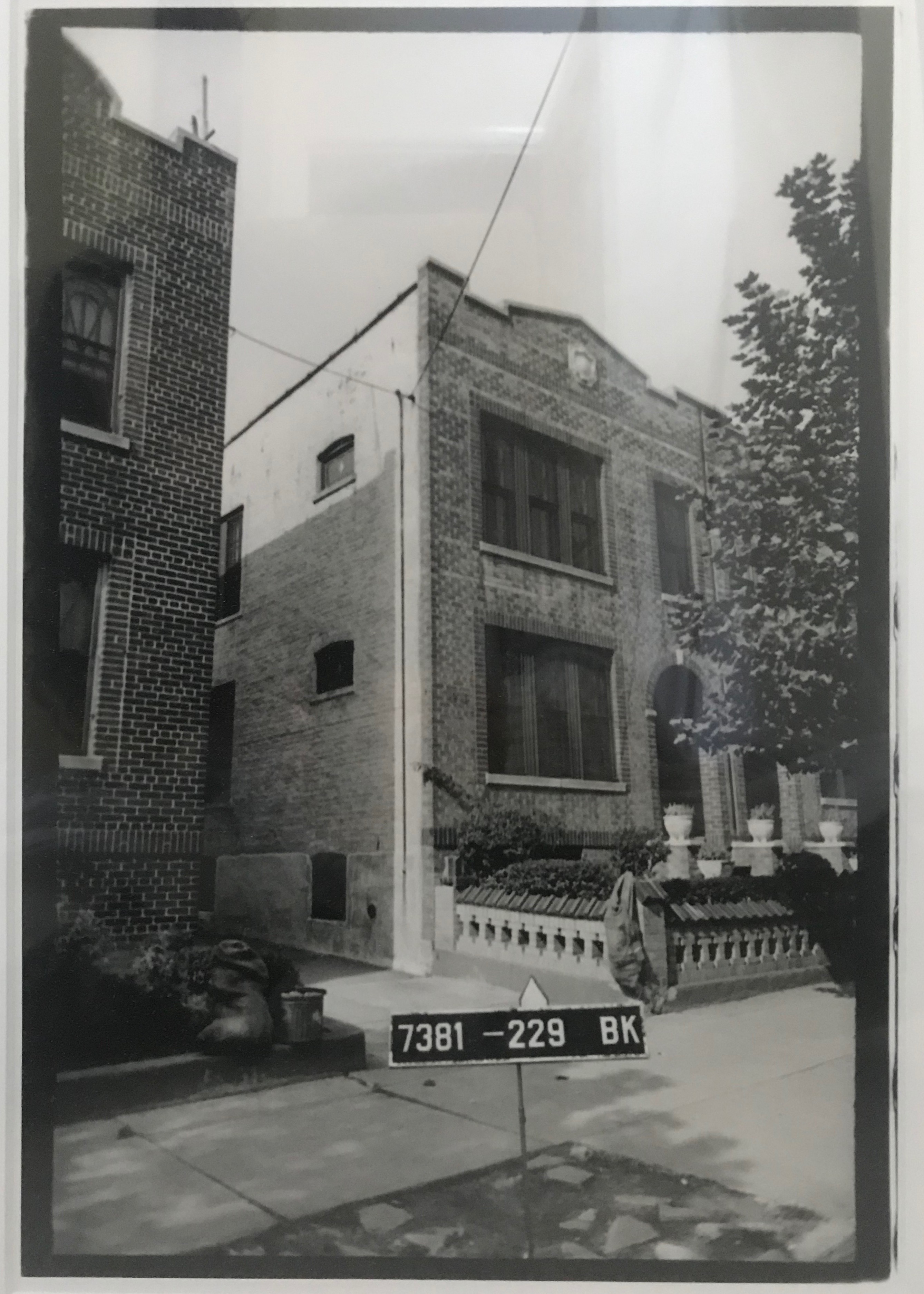

In 1925, when she was 5 years old, my mom Zelda and her family moved to East 23rd Street. Two years later, when he was 8 my dad and his family moved in with their cousins 5 houses down the street. Eventually 5 generations of my family lived in my mom’s house.

Like most of the neighborhoods in Brooklyn this was an immigrant community, ours made up of Eastern European Jews and Italian and Polish Catholics. My dad had a very high tolerance for, and acceptance of, other people’s imperfections and eccentricities. As a result, many of the small-time gamblers and colorful characters in the neighborhood were his buddies and associates. Guys like Tommy Meatball, Ernie the Crutch, Whitey, Moe the Book and Frog. From the time I was 5 years old my dad exposed me to sports betting, gin rummy and poker games, crap games, and when I was 10, he started taking me out to Aqueduct race track. In those days not only could a 10-year-old be admitted to the track, but I was allowed to go to the window to place and collect bets for my dad and his friends.

There was nothing I liked more than being with my dad and listening to his buddies talk about their travels, World War 2, Las Vegas showgirls, or gambling wins and losses. When I was 12, I fell in love with the writing of Damon Runyon because the characters in his short stories reminded me of the guys in my neighborhood. As many of you may know, in 1950, one of the most popular musicals of all time, Guys and Dolls, was created based on his characters (from his story, The Idyll of Miss Sarah Brown).

In 1955 Guys and Dolls came out as a movie and is one of my all-time favorites.

Marlon Brando is Sky Masterson, Frank Sinatra is Nathan Detroit and Jean Simmons is Sergeant Sister Sarah Brown. I’ve seen Guys and Dolls about 20 times and I always wait for my favorite scene, which I am going to describe here because it is very relevant to some of my dad and my escapades. The scene is in Mindys restaurant in New York, and Nathan Detroit is desperate to raise $1,000 so he can rent the Biltmore garage for his floating crap game. When Sky Masterson, a very high roller who has the reputation of betting on anything, sits down at his table, Nathan tries to engage him in a bet about whether Mindy’s sells more strudel or cheesecake (he has already discovered that even though Mindys is famous for its cheesecake, they actually sell more strudel). At this point Sky tells my favorite story. “When I was about to set out on my own, my daddy pulled me aside and said, Son, since I am not very flush with cash at the moment I am not able to give you a stake to start out in life, but instead I am going to give you some very valuable advice. One day in your travels you are going to meet a man who will show you a brand new unopened deck of cards. He is going to bet you that he can make the jack of spades jump out of the deck and squirt apple cider in your ear. Now son, you will be tempted to take that bet, but I’m telling you, as sure as the sun is going to rise tomorrow, if you take that bet you will wind up with an earful of cider.” Ironically 5 minutes after giving this speech, Sky accepts a “suckers bet” from Nathan. In order to win this bet Sky has to convince straight laced Sister Sarah Brown of the local Salvation Army to go to Havana Cuba to have dinner with him the next night.

Second Grade

When I was 4 years old I started kindergarten, and when I was 5, I noticed that before my dad would call his bookie to bet on sports he would read the betting line and get the point spreads from the Daily News. Around that time I asked my dad how bookies made money and he introduced me to the concept of “vigorish.” He explained that when he bet $50 on a game and won, the bookie paid him his $50 winnings. But if he lost that bet he had to pay the bookie $55. That $5 is the bookie’s vigorish and why they made a lot of money.

So when I got to the 2nd grade I started getting the point spreads from the Daily News and I let my buddies at school bet up to a nickel on basketball games. If they lost they owed me 6 cents, a one penny vigorish. I was careful and things were going fine but another boy, Gary Brown, started doing the same thing and quickly got caught, and even quicker, he ratted me out. The teacher suspended me immediately, without even going to the principal. She told me not to come back to school without my father.

So the next day Freddy walked me to school, before work and before class started. When we went in to see my teacher she was really worked up. In a loud voice she said, “This boy is only 6 years old! What kind of school is this? My second-grade class already has its own bookie!” And she went on like that for a good while. The whole time Freddy was attentive but quiet, in fact, I don’t remember him saying anything. After we finished he and I walked into the hallway. She made it sound like what I did was so horrible that I was sure my dad was going to be angry with me and punish me.

When we were alone, he said to me in a calm, matter of fact manner, “ Marty, don’t do

this in school anymore” and he walked off and went to work.

Commodity Trading

In 1975 I lived in San Diego and my job at the National Center for Human Potential required an intensive 3 months of work in the summer, but during the year there was a lot of free time. So I took up trading silver on the commodities market. I didn’t have much money, but by being careful I was making a small profit.

Then on a trip to NY I met a Merrill Lynch trader who convinced me that his inside knowledge could generate huge profits. I needed to have a minimum investment of 10k and he said because of the speed of the markets he would have to have full discretion over all the trades. I didn’t have enough money so I convinced Freddy to go in with me. As you have probably surmised by now, this guy churned the account buying pork bellies, soybeans and orange juice futures and generated huge commissions for himself. In 3 weeks we were down to $3,500 and I closed the account. I went to see Freddy at his mattress store and I told him that I fell for a scam and lost most of his money. I could see in his face that he was a little upset about losing the money but he was quiet. Then he said, “You got greedy.” He was right and I mentally filled in the rest of the message. When you get greedy you can be conned.

We were both silent and he looked like he was trying to decide about something.

He sighed and said, “OK Marty, I am going to tell you a story I’ve never told anyone, not even your mother. The reason I never told you, Neil or Zelda, is I was ashamed. I was dumb, and I let myself be conned. I lost more money than you did. Do you remember Tommy Madden”?

Tommy Madden was a charming guy about 10 years younger than my dad who seemed to pop up in his life from time to time. He was like the other guys in the neighborhood but a little bit sketchier and no one really knew how he made money. In fact Zelda told my dad to stay away from him after Tommy came into my dad’s store one time and asked him to hold a gun for him. When Tommy left, Freddy threw it down the nearest sewer but that was enough for Zelda.

So Freddy went on to tell me that a few years ago, just around the time when his store, Frederick The Mattress King was getting successful, Tommy showed up again. When they got around to talking about what Tommy was doing nowadays he told Freddy that he had a sweet deal out at the race track. He said that twice a week the jockeys would decide who was going to win a race so they could all bet on it and get extra money. Tommy’s friend worked at the track and gave Tommy the winner in advance.

Of course Freddy wanted to get in on the sure thing and Tommy told him that he would make bets for Freddy but he couldn’t bet too much because it would affect the parimutuel payoff. Sure enough every week for about a month Tommy would come to the store and give my dad anywhere between $100-200. Then one day Tommy came running into see Freddy, bursting with excitement. He told him that an owner of a very high-class horse, worth over $100k, needed to sell quickly and was willing to take $25k cash for the horse. He said that when the horse stopped racing it would make a minimum of $25k a year in stud fees. Tommy’s only problem was that he only had half the stake, and he asked Freddy to be his partner and come up with the other 12,500. My dad liked the idea of owning a race horse and he gave Tommy the money. Nobody ever saw Tommy again. I could see how it pained my dad to tell me how he got conned. $12,500 was a lot of money to him at that time. But I think his desire to have me not be too hard on myself and to learn was stronger than his embarrassment.

Years later I came across a quote from Tom Hopkins and I thought of Freddy telling me this story. Hopkins said “ You paid for the lesson already, you might as well take the learning.”

In telling you about how Freddy handled these situations I am not holding his actions up as necessarily great parenting. Maybe it would have been better for me if he got angry, gave me consequences, and was tougher on me like they were in the monastery.

I do know that he was not a hypocrite, he didn’t judge me for things he did himself. Because he struggled most of his adult life with food and his weight, he was very accepting of people who didn’t have full control over their lives. I do know that how he treated me when I screwed up shaped a lot of who I am.